Undergraduate Tuition & Financial Aid

When it comes to paying for college, value is as important as cost. Our financial aid team is here to guide you in applying for financial aid and discovering the various options available to make your education affordable.

Supporting Students During the Government Shutdown

To ensure continued access to registration, billing holds will not be applied to students experiencing delays in receiving veteran benefits, vocational rehabilitation assistance, or ROTC funding. Additionally, payment flexibility is available for federal employees who are behind on their Fall 2025 payment plans. If this applies to you, please contact the Bursar’s Office at busoffmc@widener.edu to discuss available options.

Our Investment in You: A Commitment to Affordability

Widener University vs. Other Colleges

Large, public universities can't match our personal approach. Many private colleges lack our blend of modern facilities, well-connected alumni, and leading academic programs. What does that mean for you? Everything.

Limitless Support + Opportunities = Proven Results

The people of Widener will embrace your goals and challenges. Faculty will provide one-on-one mentorship. Alumni will help build your network. The relationships you build, skills you develop, and knowledge you gain will set you up for long-term success. Just ask our alumni:

- 95% of our 2024 grads achieved their career goals within six months of graduation.

- $70,300 early career salary: median for 2024 graduates.

- $113,000 mid-career salary: median for bachelor's degree alumni (top 22% nationwide).

Undergraduate Tuition & Costs

Keep in mind, nearly 100% of incoming students receive generous scholarships. Costs shown do not factor in this substantial savings, in addition to other savings opportunities like Federal Pell Grants, Federal SEOG Grants, and other financial benefits. Actual costs also depend on selected housing and meal plan, as well as additional fees for specific majors.

To view your personal costs to attend Widener, submit your admission application and FAFSA.

Estimated Tuition & Costs —

Fall 2025-Spring 2026 Academic Year

| FALL | SPRING | TOTAL | |

| Estimated Annual Tuition & Fees* (2026-2027) | $29,430 | $29,430 | $58,860 |

| Estimated 1st Year Annual Housing** | $4,610 | $4,610 | $9,220 |

| Estimated 1st Year Annual Food (Meal Plans)** | $3,775 | $3,775 | $7,550 |

Estimated Total Annual Billable Costs | |||

| Residence Hall/On-Campus Students | $37,525 | $37,525 | $75,050 |

| Commuter/Off-Campus Students | $29,140 | $29,140 | $58,280 |

Costs for upperclassmen (second-year students and beyond) as well as

more detailed information about tuition, housing, and meal plan costs can be found on the Bursar's Website.

* Engineering students pay an additional $2,650 fee annually. Nursing students pay an additional $1,600 fee annually.

** Estimated annual first-year housing and food (meal plan) is displayed. Costs for second-year and beyond students vary by housing and meal plan selection.

Your investment in Widener's tuition and fees powers our high-caliber faculty, facilities, student resources, events, amenities, and technology across campus. It's the financial contribution that makes a Widener education the platform for success that it is today.

Room and board, required health insurance, as well as books/course materials are not included in your tuition. For a complete breakdown tuition and fee costs, visit the Bursar's Office.

Health Insurance Requirement: If you do not have health insurance coverage, you may accept university-sponsored student health insurance at an additional expense. Visit health services for more information.

Additional Fees for Specific Majors

- Engineering majors - additional $2,466 per academic year

- Nursing majors - additional $1,112 per academic year

Nursing Programs with Varied Tuition Structures

Online, Part-Time Programs

Online, part-time undergraduate programs follow the adult and continuing studies tuition structure.

Financial Aid & Affording Your Education

What is financial aid?

Financial aid is funding used to cover college expenses in the form of scholarships, grants, loans, and work-study. This funding can be used to pay for the bulk of college expenses, like tuition and fees, room and board, books, and more.

Widener offers generous financial aid. Once you apply to Widener, you'll automatically be considered for merit scholarships and grants awarded not only for academic achievements, but also for diverse talents and skills that enhance our vibrant community.

In addition to aid made available through Widener, you can also receive government-sponsored funds in the form of federal student aid.

Estimate your cost of attendance

Want help estimating your eligibility for financial aid and your annual cost per year to attend Widener University? The Net Price Calculator can give you an idea.

What is the FAFSA and why is it so important?

This free, online application is the gateway to grants, loans, and other forms of financial aid. Every year, the U.S. Department of Education offers billions of dollars in financial aid to eligible students. Widener gets in on the action, too, annually awarding aid to students with need.

There's only one way to determine your eligibility for this funding: by completing the FAFSA.

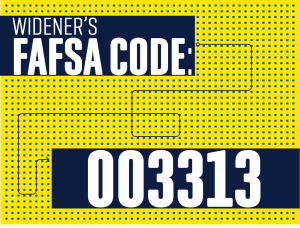

Widener University's FAFSA school code is: 003313

The FAFSA is a crucial tool for navigating the costs of higher education. Even if you don’t think you’ll qualify, submitting the form unlocks resources that are vital to supporting you or your student through college. Here’s why FAFSA completion is so important:

- Completing the FAFSA makes students eligible for Federal Direct Loans, which have lower interest rates and more flexible repayment options compared to private or personal loans.

- Many states and colleges use FAFSA information to award their own financial aid, including grants and scholarships. Some of these awards are not solely based on financial need.

- Some colleges require a completed FAFSA to consider students for last-dollar scholarships. These scholarships can be applied toward any remaining tuition and fees after all other forms of aid have been exhausted, including federal and state grants, scholarships, and loans.

- If a family's financial circumstances change unexpectedly, having a FAFSA on file can speed up the process of assessing whether a student qualifies for adjustments to their FAFSA information. These adjustments could make the student eligible for additional financial aid.

- Completing the FAFSA ensures that families have explored all potential financial aid opportunities, providing peace of mind that they are not missing out on available resources

We want to have an informed conversation with your family about this important financial decision—and having a FAFSA on file enables us to do just that.

Questions? Contact us today.

More Ways to Finance Your Education

Scholarships and grants provide helpful ways to fund your education, and the best part is you don't have to pay them back after graduation!

Scholarships recognize your hard work, achievements, and unique talents! Apply to scholarships such as academic, merit scholarships; Maguire Foundation Endowed Scholarships, and more.

Grants are aid made available by the federal and state governments based on financial need or personal experiences like military affiliation or being a student that was in foster care. Widener also has its very own Grant-In-Aid program to assist eligible students. Apply to grants such as Federal Pell Grant, state grants, and more.

Loans are borrowed money that is repaid with interest and are helpful financial resources available after other options have been exhausted.

Many options are available for students to earn income by working at the university through the federal work-study program and direct university employment.

Widener is proud to offer numerous opportunities for military-affiliated students to finance their education.

Have a question? We're here to help. The same mentorship you can expect as a student is available in helping you navigate the important process of finding your "right fit" college.

Undergraduate Admissions Office

-

Muller Hall

University Pl

Chester, PA 19013

- 888-WIDENER

- admissions.office@widener.edu

Student Financial Services

-

Lipka Hall, Corner of 14th and Potter Streets

- 610-499-4161

- finaidmc@widener.edu