Determining eligibility

In order to receive a financial aid offer, students must meet certain eligibility requirements.

Here are the general eligibility requirements for most financial aid programs:

- Must demonstrate financial need

- Be a U.S. citizen or eligible noncitizen

- Be enrolled or admitted for enrollment as a regular student in an eligible degree or certificate program

Applying for aid

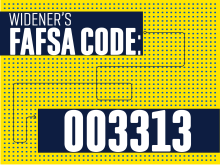

Students need the following items to complete the FAFSA:

- Social Security number, or, if applicable, alien registration number

- Student's W2 and/or 1099 forms from two years prior

- Federal tax return from two years prior. All families are encouraged to use the IRS Data Retrieval Tool to save time and reduce errors providing tax information.

- Current information related to assets (e.g., bank statements, stocks, bonds, etc.)

- Household information (e.g., household size, number of family members in college, parent marital status, student marital status, etc.)

- FSA ID: This is a unique ID that provides access to Federal Student Aid's online system and can serve as a legal signature. Both the student and at least one parent need separate FSA IDs.

In nearly all cases, graduate and continuing studies students are considered independent students and do not need to provide parent information.

If at any time you have questions or are unsure what to do, we are here to help. Please contact the financial aid team for assistance.

What should I expect after I submit the FAFSA?

The U.S. Department of Education's Office of Federal Student Aid will let us know once your FAFSA has been processed so we can begin our review.

You can review your status online and will receive a Student Aid Report (SAR) within a few days after submission. This will summarize all submitted information and allow you to review for any required changes.

If your aid offer includes a federal loan and you are a first time borrower, there are a few more steps to take in order to receive the loan.