SAP Recognition Award Certificate

Advantages

Learn the tricks of the trade on the world-class enterprise software that business professionals use every day.

Outcome

Fortune 500 Accountant

A degree in accounting at Widener prepares you with the financial and analytical skills to speak the language of business.

Major & Minor

On Campus

As an accounting major, you'll do much more than just crunch numbers. From business leadership and management strategy to tax law changes and government regulation, you'll learn how to make informed decisions for people and companies across the globe.

Explore a cutting-edge concentration in forensic accounting, network with our successful alumni or jump into a co-op or internship with one of our many industry partners. No matter how you customize your degree, you'll graduate ready to ace your CPA/CMA exam and lead public, private, and non-profit organizations on the path to healthy financial futures.

The School of Business Administration is accredited by the Association to Advance Collegiate Schools of Business (AACSB). This professional accreditation places Widener among the top one-third of college business schools in the U.S. and Europe.

The accounting program ensures all students graduate with the financial and analytical skills to succeed. The accounting degree is 127 credits over eight semesters. Several of the required courses are four credits, which means that if a student meets certain qualifications, he or she can earn an additional three credits per semester at no additional tuition cost.

View Loading....

Obtain a more in-depth understanding of issues related to common federal taxation matters pertaining to individuals, corporations, pass-through entities, and estates. This track is ideal for students who plan to complete the Tax Compliance and Planning specialty area of the CPA exam starting in 2024.

View Loading....

Designed for students who wish to pursue the Certified Management Accountant (CMA) designation from the Institute of Management Accountants. The CMA exam is a rigorous two-part examination that students can take while they are still undergraduates. This concentration also aligns well with the Business Analysis and Reporting specialty area of the CPA exam starting in 2024.

View Loading....

Develop expertise in the area of financial fraud examination, detection, and prevention. This concentration is an advanced specialty within the accounting major and is interdisciplinary in nature including courses from social science, computer science, criminal justice, and philosophy.

View Loading....

College is about exploration. At Widener, you'll complete a general education curriculum that supports just that. You'll have the flexibility and freedom to dive deep into the topics that spark curiosity, challenge your mind, and power your personal and academic growth.

Along the way, you'll cultivate critical, meaningful skills employers seek, including:

It all starts with ASC 101: Thinking Through — a selection of around 40 course topics that will encourage you to go deeper and examine complex issues that shape our world and our ways of relating to one another. When you dive into the possibilities, you're sure to find multiple courses that inspire and intrigue you, regardless of whether they align with your major! Think of it as an opportunity to step outside of your comfort zone and truly learn something new. Then, in your senior year, you'll come full circle with a capstone course that takes your Thinking Through topic to new heights strengthened by everything you've cultivated along your college journey.

The accounting program is designed for students to customize their education and meet the 150 credit-hour requirement to become a Certified Public Accountant (CPA). Let us help you choose a path:

Although all students are encouraged to pursue the CPA, we also know some students may be more interested in becoming a Certified Management Accountant (CMA), a highly-valued credential in private industry.

Learn more about our accounting program in this video.

Earning an accelerated master's degree will enhance your job opportunities and prepare you for rapid career growth—all while saving you time and money.

As a major within the School of Business Administration, you have the unique opportunity to complete bachelor's and master's degree Loading... in five years. In addition to your business major of choice, you can choose to pursue a master's in business administration (MBA), business innovation (MS), or taxation and financial planning (MS).

Widener also makes it possible to complete a 4+1 degree in a different field of study through our Accelerated Advantage 4+1 program. Master's degrees can be earned in allied health education (MEd), criminal justice (MCJ), organizational development and leadership (MA), and public administration (MPA).

Our acclaimed co-op program and emphasis on internships will transform your powerful Widener education into action, helping you gain the experiences, connections, and career-building moments that will benefit you for a lifetime.

Tap into powerful networks of faculty mentors and Career Design & Development professionals to secure real-world work experience that matches your career goals.

The best part? You can get paid and still graduate on time.

The business honors program is an exciting opportunity for academically talented students to enrich their business education with advanced honors courses, an honors seminar, collaboration with faculty on research, civic engagement, and professional and leadership development opportunities.

Students can complete their program of study in 4 years graduating with a certificate of honors in business.

Students are admitted to the School of Business Administration Honors Program as entering first-year, based on high school GPA and academic credentials. If numbers permit, then additional students may be admitted at the end of their first year (based on GPA).

Learn the tricks of the trade on the world-class enterprise software that business professionals use every day.

Fortune 500 Accountant

Study criminal behavior and the justice system to learn how to combat white-collar crime.

Forensic Accountant

Expand your knowledge of business ethics and the political and legal implications of the tax code.

Tax Associate

Join this growing field. The number of accounting and auditing jobs is expected to grow 6% by 2031, according to the Bureau of Labor Statistics 2021-2031 employment projections.

per year (2021 median pay for accountants)

Widener's unique Executives in Residence program brings industry leaders to campus, providing you with career mentorship and networking opportunities with experts in the field.

Industry leaders within our accounting and information management advisory board also provide networking opportunities to students and support the program in its future growth and competitive development.

Live and learn with fellow business classmates in our Business (Developing Entrepreneurs) Living Learning Community (LLC). This unique experience enables you to form even closer relationships with business majors outside the classroom. You'll also have the opportunity to join various clubs and organizations to expand your network and engage with Widener business alums and faculty.

We want to get to know you and see you succeed. Professors will pay attention to how you learn and what you want to accomplish. Your Personal Student Success Team—faculty and peer mentors and liaisons for campus resources—will make sure your first year runs smoothly.

Without skipping a beat, you’ll have what you need to make Widener your second home. And you’ll know how to invest in the greater community, from professional opportunities in Philadelphia to volunteer experiences in your new backyard.

Lean more about faculty mentorship

Explore resources for academic & career support

Find support for health & wellbeing

"Widener has exposed me to opportunities that forever shaped my life. Now, as a well-traveled entrepreneur with a young but growing business, I am excited to see how Widener University is still preparing graduates toward a path of excellence."

"Students who complete our Taxation & Financial Planning programs graduate to become industry leaders in the financial service field. They work in home offices and boutique financial planning firms. Their careers have a positive impact on thousands of clients."

Jack ’78 and Nancy Dwyer’s gift -- the biggest in Widener’s history -- will rename the nursing program and advance its mission of graduating nurse leaders.

Filing taxes can become a time consuming and costly annual process for many Americans. Students from the School of Business Administration helped to alleviate that burden this tax season.

Faculty in the School of Business Administration found an opportunity with the Philadelphia Union to have students interacting directly with fans for hands-on research experience that has international potential.

Our admissions and financial aid teams are here to support you every step of the way. Have a question? Ask away!

Applying to Widener is easy—and free! Simply complete our Widener Application or the Common Application. You'll also need your official high school transcript and either an admissions essay or your SAT/ACT scores. We're a test-optional school, so there's no need to submit both.

Know you're interested in applying to Widener but unsure if you're ready to zero-in on a major? You can apply as an Exploratory Studies student with an undecided major. This program will help you start your college journey on the right foot while you explore which undergraduate program is the right fit for you.

We accept applications on a rolling basis—there are no hard deadlines. Apply when you're ready and we'll take a look as soon as we receive your app.

Key dates to keep in mind:

Once we receive your application and all materials, you can expect to hear back from us quickly. Along with your application decision, you'll also find out about any merit-based scholarship awards. You're automatically considered for merit scholarships as soon as you apply—you don't need to apply separately.

If you apply before November 1, you are considered an Early Action applicant which comes with benefits like:

All applications are non-binding, so why wait? Apply today!

Our admissions team will help you make the most of college-level credits earned after high school. We maintain strong partnerships and articulation agreements with numerous local community colleges and also accept a wide range of course credits earned at accredited colleges and universities.

Curious about how many credits may transfer? Email your transcripts to transfer@widener.edu and our transfer coordinator will personally review your coursework as an unofficial credit evaluation. Applicants are given priority during busy seasons, but you don't have to apply to work with our transfer coordinator.

Transferring doesn't have to be a guessing game—share your stats and we'll take it from there!

Widener University serves as a "second home" for students from around the world. We are located just outside of Philadelphia and close to New York City and Washington, D.C.—offering many unique professional and personal opportunities to explore.

Want to know what it's like to be an international student on campus or need assistance navigating English proficiency requirements? We're here to help, and our international admissions director will support you through the application process.

This support doesn't end with admissions—our International Student Support team will serve as a valuable resource throughout your Widener journey—meeting Visa/immigration requirements, getting acclimated to campus, and much more.

Learn more about applying as an international student

Learn more about life at Widener as an international student

Because Widener is a private institution, we're able to offer financial assistance that brings an exceptional education within reach. Complete your admissions application today to determine your financial aid package, including scholarships and grants.

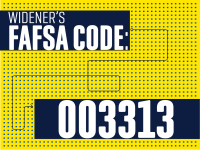

Submitting the Free Application for Federal Student Aid (FAFSA) is the first step to getting you the financial assistance to make the cost of college—an investment in your future—affordable. This free, online application is the gateway to grants, loans, and other forms of financial aid. Every year, the U.S. Department of Education offers billions of dollars in financial aid to eligible students. Widener gets in on the action, too, annually awarding aid to students with need.

You and at least one parent or caregiver will need a separate FSA ID to access the Federal Student Aid's online system and serve as your legal signatures. Make sure to create your unique FSA IDs before you get started. Our school code is 003313.

Nearly 100% of new full-time undergraduate students receive significant financial aid offers that reduce out-of-pocket costs and make a Widener education not only affordable, but well worth the investment. In fact, once your total financial aid is calculated, the cost of a Widener education is often equal to if not lower than other competitive universities–but with far superior outcomes for your career and earning potential.

The first step to see how much aid you qualify for is submitting the FAFSA.

Funding you don't have to pay back after graduation? That's a win-win! Scholarships and grants are a way for the university and other organizations to honor the academic, merit, and talent-based achievements of our students.

In the Accelerated Advantage 4+1 program, you can save up to a year of tuition by pursuing a master's degree—resulting in thousands of dollars in savings. During your fifth year of study, you can also apply for graduate-level scholarships and assistantships to further reduce education costs. To learn more about graduate scholarships and assistantships, please speak with your academic advisor during the spring semester of your senior year.

Tap into our wide network of Philly-area employers and experience a full-time, paid co-op. In addition to earning an income, you do not pay tuition while on co-op. You can also choose to live on campus, at home, or even travel for your co-op.

To visit Widener is to fall in love with the place. But don't take our word—experience it for yourself. Plan a visit to connect with our students, faculty, and staff.

We offer a variety of events to get to know Widener—from virtual sessions, workshops, and private tours, to the big splash of our signature open houses.

Have a question about Widener? Drop us a line and an admissions counselor will be in touch. We're always happy to help!

Applying online is easy—and it's free! We also accept the Common Application. Take the next step toward joining the Widener Pride.

Muller Hall

University Pl

Chester, PA 19013

Academic Center North

Room 166